The hedging costs in EUR/USD will increase further toward the end of the year by the cross-currency basis spread. This INSIGHT explains its implications for passive and active currency hedging strategies and how they can even benefit from this development.

Increasing hedging costs

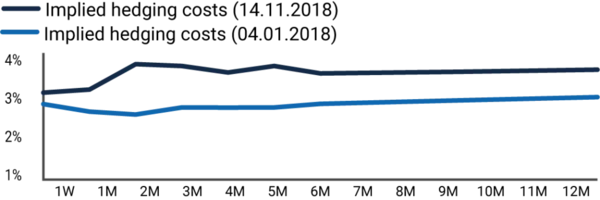

The cost of hedging the EUR/USD currency pair continued to rise in 2018. At the beginning of the year, the cost for a three-month currency hedge was at approx. 2.20% p.a., but has risen to approx. 3.50% p.a. (Source: 7orca Asset Management AG, Bloomberg. (04.01.2018 vs. 14.11.2018) The chart below compares the current implicit hedging costs with a hedging term of one week to twelve months as at 13.11.2018 with those of 04.01.2018).

Fig. 1 | Hedging costs per tenor

Source: 7orca Asset Management AG, Bloomberg (13.11.2018 vs. 04.01.2018)

In addition to a divergent interest rate policy between the FED and the ECB, the phenomenon of the cross-currency basis spread (basis spread) is pushing up hedging costs in EUR/USD towards the end of the year. In simplified terms, the basis spread is a measure of the supply and demand ratio for the funding in different currencies.

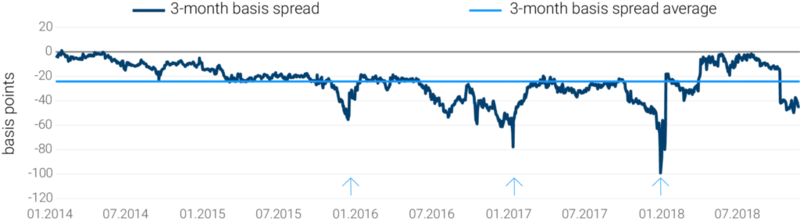

Historically, the basis spread has been close to zero based on the assumption of continuous access by banks to interbank financing. Since the beginning of the financial market crisis in 2007, however, the basis spread has drifted apart. The level of the basis spread is currently driven in particular by credit risk premiums and liquidity concerns. The increased regulation also prevents an arbitrage by market participants, leveling the basis spread. The shift in the basis spread in EUR/USD since the beginning of 2014 has averaged approx. 24 basis points (bps) p.a. in favour of the USD. In the case of a three-month hedge beyond the turn of the year, the basis spread is currently as high as approx. 50 bp p.a. in favour of the USD (Sources: 7orca Asset Management AG, Bloomberg. 13.11.2018)

Fig. 2 | Development of the 3-month EUR/USD basis spread

Source: 7orca Asset Management AG, Bloomberrg (04.01.2018 – 13.11.2018)

The above chart shows the 3-month basis spread over time. Note its structural shift into negative territory and its seasonality. Since the USD shortage is particularly pronounced at the turn of the year, a seasonal effect has been observed in the basis spread over the past few years for hedging terms beyond the year-end.

Once again this year, this phenomenon will occur and the basis spread has already widened significantly in the tenors that extend over the year-end. For comparison: In December 2017, the 3-month EUR/USD basis spread recorded a change from approx. -50 bps p.a. to approx. -100 bps p.a.

The implications of the basis spread on currency hedging strategies

The development of the EUR/USD basis spread has direct implications for currency hedging trades and is reflected in increased costs for European investors. The premiums on forward exchange transactions are made up of the different interest rate levels between the two currencies and the basis spread. Thus, the hedging costs in the EUR/USD currency pair are currently rising due to both components: the higher interest rate level in the United States and the basis spread in favour of the USD. In contrast to the higher interest rate level, however, the investor is not compensated for the basis spread. The basis spread increases the costs of currency hedging without offering a potential return.

For investors, this raises the question of how the negative effects of the basis spread on currency hedges can be reduced to a minimum. We shed light on the implications for both passive and active hedging strategies.

In the case of passive currency hedging, the choice of the hedging term and the time of prolongation are decisive parameters for the success of the hedging strategy.

The choice of the term is very important, as different maturities can have significant interest rate differences. This is based on the yield curves of the two currencies. Currently, the interest rate difference in EUR/USD is approx. 2.7% p.a. in the one-month range and approx. 3.1% p.a. in the six-month range (Sources: 7orca Asset Management AG, Bloomberg 04.01.2018 – 14.11.2018).

In addition to the choice of the term, however, the development of the basis spread must also be taken into account. This is of significant importance when determining the time of prolongation. Due to the seasonal effect in particular, it may prove useful to prolong the hedge early over the turn of the year in order not to be at the risk ofn negative developments at the end of the year.

In the current market environment, where the basis spread is significant and the interest rate level between the two economies diverges significantly, both factors should be taken into account for passive currency hedging. A strategy that does not consider these factors can lead to a considerably worse economic result.

For active currency hedging, where the degree of the hedge is dynamically adjusted to market developments, timing by selecting specific hedge dates is difficult.

In any case, hedging is dynamically built up or reduced depending on the development of the foreign currency. With an active currency overlay, the dominant performance driver will always be the decision as to when the hedge ratio will be adjusted and to what extent.

However, a professional active currency overlay should always integrate the hedging costs into its decision-making process, since the more significant the costs due to different interest rates and basis spreads, the greater the effect on the hedging efficiency.

Profit from the basis spread through synthetic positions

As the basis spread has been negative for some years now, the question arises as to whether there is any possibility of profiting from this development.

As shown above, the basis spread for European investors has a negative effect on currency hedges. However, on the investment side, this phenomenon also offers the possibility of generating an additional return. If the investor is able to take a synthetic position instead of a physical investment, the basis spread can be earned. The synthetic position replicates the performance of a comparative investment through the use of derivatives. In this case, the investor uses the basis spread advantageously and earns the basis spread through the forward purchase of the currency in addition to his investment return.

This possibility is illustrated by the example of a passive S&P 500 equity investment. In the case of a physical investment, the investor would buy USD and then invest in the stock market (e.g. by buying an S&P 500 ETF). This would allow him to benefit from a rising equity market and an appreciation of the USD against the EUR.

The same payout profile could be achieved by buying USD using forward exchange contracts and simultaneously taking a long position in the S&P 500 future. The USD forward purchase enables the USD to be bought at a discount to the basis spread and a yield pickup to be generated.

The same logic applies, of course, to currency-hedged S&P 500 positions. In this case, the forward purchase of the currency would have to be waived. The only decisive factor is that the underlying investment can be replicated using a derivative. This strategy also avoids the basis spread in comparison to the physical USD investment with subsequent currency hedging.