The currency risk of institutional portfolios can contribute significantly to the risk profile, especially when expanding the global investment universe. Undoubtedly, the decision to engage in professional FX hedging is not a trivial matter. One concern often raised is that by hedging FX risks through a dedicated currency manager, the investment managers of the different portfolio building blocks would be limited in their alternative actions, thus limiting their potential to generate alpha. The good news up front: both are mutually compatible.

In this INSIGHT, 7orca will outline which options exist to efficiently hedge your currency risk without limiting the investment managers‘ options for action.

FX Hedging: Background and Objectives

When implementing a central currency overlay, the responsibility for currency hedging often passes from the investment managers of the individual portfolio components to 7orca (for example, for the FX risks from their equity, bond or real asset allocation). In particular, the objectives shown in figure 1 should be met – or maintained.

Fig. 1 | FX Overlay Goals

Source: 7orca Asset Management AG

Besides, 7orca always pursues the goal of maximising efficiency benefits for the investor by managing all currency hedges in a centralised approach. This goes hand in hand with the fact that we do not restrict the investment managers‘ scope for action and do not distort the measurement and allocation of their performance. At the same time, we do not unduly increase the complexity of portfolio management.

Different Investment Styles – Different FX Hedging Programmes

The investment styles, processes and objectives of the investment managers are generally not homogeneous, which means that different approaches may also be required for hedging currency risks. These are identified by 7orca as part of analysis prior to the launch of a currency overlay mandate and represent a significant calibration factor for the FX hedging strategy.

In the following, we present two examples of how investment styles that

- View FX risks as an undesirable by-product if international diversification or

- Understand the foreign currency as value-driving factor

of the investment strategy are taken into account in the currency overlay strategy.

Examples of Investment Styles with and without Active Currency Positioning

1. Equity Mandate without Active Currency Positioning

For example, a global equity mandate is managed relative to a global benchmark, the MSCI All Countries World Index in EUR (unhedged). The investment manager selects stocks purely on the basis of expected returns, accepting

currency fluctuations relative to the benchmark. The return expectation of the equity mandate is mainly driven by the stock selection; the unintended currency positioning is negligible for the performance of the alpha. In other words, the return expectation of the stock selection is more pronounced than that of the unintended currency positioning. So far, the manager does not hedge foreign currency exposure (neither in absolute terms nor relative to the benchmark).

2. Emerging Markets Mandate with Active Currency Positioning

An emerging markets fixed income mandate has a composite benchmark of

- 70% FX hedged hard currency benchmark

JPM EMBI Global Diversified ex CCC Euro Hedged - 30% FX unhedged local currency benchmark

JPM GBI-EM Global Diversified Composite in Euro unhedged

The investment manager can dynamically manage the local currency exposure between 0% and 50%. He manages it based on his forecasts of both the exchange rate development and the interest rate development of the

two economies (relative value aspects). So far, the manager hedges the currency risks himself: A relative deviation from the 30% unhedged FX benchmark is not hedged if the manager uses a forecast on the exchange rate

development as a basis. If, on the other hand, the deviation results from relative value aspects (interest rate expectations), the manager would hedge the FX risk in order to keep the mandate neutral against the benchmark (in terms of currency allocation).

There are different approaches to designing an effective currency overlay strategy that takes into account the investment styles of the individual mandates. We would like to outline these first before explaining their application to the examples given above.

How to Design an Investment Style-Based FX Hedging Strategy

In principle, the following elements can be selected for the design of a requirement-based FX hedging strategy:

1. FX Exposure Hedging by the Currency Overlay Manager

In this case, 7orca receives regular reports on the existing FX holdings for the respective investment managers that are part of the currency overlay programme and hedges them. This is appropriate whenever currencies do not represent a value-creating investment source in the manager‘s investment process and the manager does not have a strong FX view.

2. Benchmark analouge Hedging by the Currency Overlay Manager

7orca does not use the actual FX holdings for the FX hedge in this case, but bases the hedge on the FX allocation of the corresponding benchmark for the mandate. In this way, deliberate deviations from the currency allocation of the benchmark can be reflected and alpha opportunities can be preserved.

3. Blacklisting of Segments

Certain investment managers are excluded from the global currency overlay programme. The background may be a general decision against hedging or the hedging of foreign currency holdings by the investment manager (for example within the framework of a total return mandate). During the initial analysis phase of a mandate, it is ensured that the appropriate hedging strategy is selected for the investment style of each investment manager. As a result, different mandates/investment managers may have different approaches to FX hedging. In addition to the design of the hedging strategy, a decision must also be made as to whether or not the investment manager

may continue to hedge:

a. Currency Hedging by the Investment Manager

The investment manager may continue to engage in FX hedging irrespective of whether its mandate is hedged in the central currency overlay or not.

b. No Currency Hedging by the Investment Manager

Currency hedging by the investment manager is excluded by the investment guidelines. The responsibility for currency hedging lies solely with the currency overlay manager.

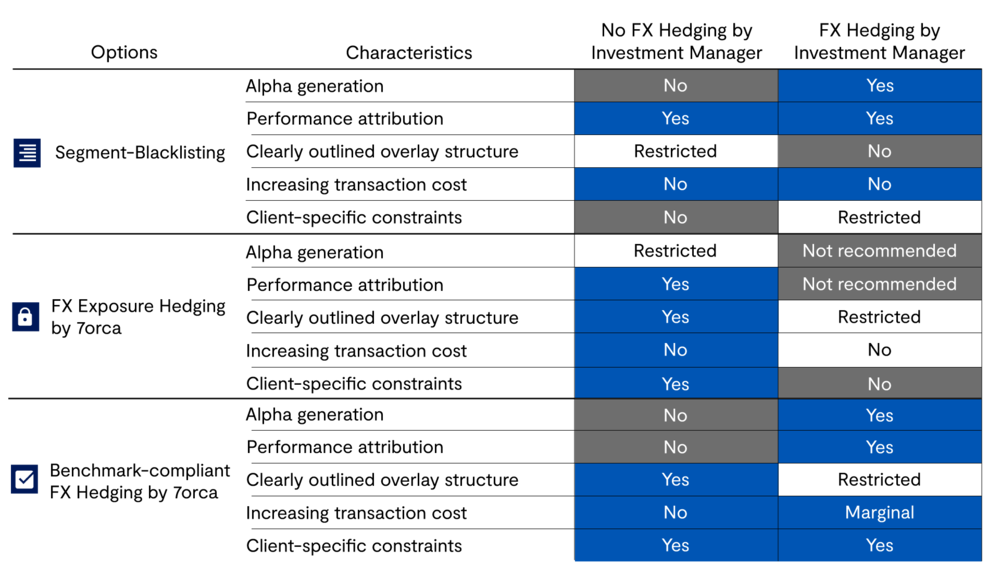

The decision matrix in figure 2 on the following page compares the different hedging options, the hedging activities of the investment managers and the impact on the above FX hedging objectives.

Fig. 2 | Decision Matrix: FX Hedging or no FX Hedging by the Investment Managers 2

Source: 7orca Asset Management AG

Application to the above Examples

With the implementation of a central currency overlay mandate, 7orca takes over the aggregated currency hedging of an investor across different investment managers in a currency overlay segment. The integration of the mandates into the central currency overlay may affect the mandate benchmark of the respective investment managers and their allowance to engage in FX hedging. For the two investment managers in the examples described above, this would mean the following:

1. FX Hedging of the Equity Mandate without Active Currency Allocation

In the case described, the FX exposures are the unintended by-product of the stock selection; the manager does not intend to make a profit by changing the currency allocation relative to the MSCI World.

If a similar mandate is to be integrated and hedged in a central currency overlay, it is recommended that 7orca hedges the investment manager‘s FX holdings. This keeps the investment manager‘s focus on alpha generation through stock selection.

The benchmark for the investment manager remains the MSCI All Countries World Index in EUR unhedged. The possibility of FX hedging by the investment manager should, however, be consistently excluded in his investment guidelines.

2. FX Hedging of the Emerging Markets Mandate with Active Currency Positioning

Here, the relative currency positioning to the benchmark represents an active part of the investment manager‘s investment style. Depending on whether he makes his investment decision on the basis of the interest rate development or his FX forecast, an FX hedge is expedient (interest rate forecast) or not (FX forecast). In this case, it is advisable to hedge analogous to the currency allocation of the benchmark:

For FX hedging, the hard currency benchmark JPM EMBI Global Diversified ex CCC Euro Hedged is changed to JPM EMBI Global Diversified ex CCC Euro Unhedged. The local currency benchmark remains JPM GBI-EM Global Diversified Composite in Euro unhedged. 7orca hedges the currency holdings in line with the two currency allocations of the benchmark.

In order for the manager to maintain his full alpha potential, he should be able to continue currency hedging. The objective of the currency overlay is to reduce the currency risks of this mandate efficiently and cost-effectively in

the central overlay segment in a far-reaching and systematic manner. The central management of FX risks offers numerous efficiency advantages compared to a decentralised management in the individual mandates. Detailed information on this can be found in our INSIGHT publication „Structural advantages of a Dedicated FX Overlay“.

The investment manager‘s hedging transactions are now exclusively for alpha generation. In the long run, his alpha may increase as the previously potentially necessary adjustments in his portfolio to service cash flows for FX hedging are avoided and a focus on his core competencies is achieved.

7orca – your Currency Sparring Partner

Use us as your sparring partner. With more than 20 years of experience in FX overlay management, we put our professional expertise and our state-of-the-art infrastructure at the centre of everything we do for our clients.

We would be pleased to develop the most suitable, target-oriented hedging strategy together with you within one of our currency workshops.