Highlights

- In our 2022 Year in Review, we highlight how the Ukraine war and geopolitical tensions caused inflation, how the major central banks acted and what this meant for FX markets

- You will find the essential information on the most important foreign exchange markets worldwide, the effects of the central banks‘ interest rate steps, the special features of selected currency regions and an outlook for 2023 clearly summarised in one chapter

- In the section „Eurozone and United States“, the authors shed light on the reasons for a weak Euro versus the US dollar against the background of reactive US central bank measures on inflation and a continued weak European economy

- We explain why there could be prospects of an improved economic situation for the UK in 2022 despite fiscal policy turbulence and what hurdles there are to overcome for a more stable British Pound

- Switzerland has been able to escape inflationary pressures in the medium term and current monetary policy continues to support a strong Swiss franc

- We describe the strong trade links between Australia and China as well as the effects on both trade balances and the AUD/CNY exchange rate

1 FX Market Review 2022

Rising interest rates – a new regime?!

An eventful 2022 lies behind us: pandemic, inflation, interest rate turnaround, recession, geopolitical conflicts in Taiwan and, last but not least, Russia’s brutal war in Ukraine have left deep scars. The capital markets experienced some severe distortions and high volatility across all asset classes. The price explosion resulting from a mixture of disrupted supply chains, debt-financed fiscal stimuli and the energy shortage caused by Russia’s failure as a supplier has now reached almost all regions of the world and is leading to social, economic and monetary turning points.

The monetary policy turnaround has the most serious effect on the capital markets. The low interest rate policy implemented after the 2008 financial crisis in the USA and the 2014 sovereign debt crisis in Europe has ended for the foreseeable future. After the central banks underestimated the price development in their forecasts and assumptions for a long time, „transitory“ has now become „persistent“ in the language of central bankers.

US dollar as a safe haven appreciated, Euro weak

The Fed responded by raising interest rates at the fastest pace since the 1970s. Traditionally high-risk and low-risk assets alike lost value. Yields on government bonds rose to heights not seen in a long time and the US dollar, a classic safe-haven currency, appreciated sharply.

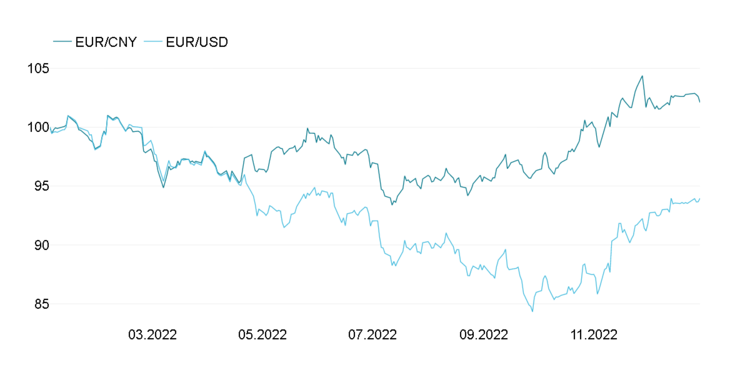

In Europe, the reaction was delayed, which had a corresponding effect on the common currency and led to a sharp depreciation against the US dollar and other USD currency areas (cf. Figure 1). Much of this decline can be explained by the widening interest rate differential, although vulnerability with respect to Russia as a major energy supplier contributed.

Figure 1 | Change in value of selected currencies versus the Euro since the beginning of 2022

Source: 7orca Asset Management AG, Bloomberg (01.01.2022-31.12.2022)

British mini-budget intensified devaluation of the British Pound

The UK was hit even harder by the price shock, which led to the highest interest rate move since 1989. Massive interim turbulence in the trading of long-dated British government bonds (Gilts), triggered by the Truss government’s mini-budget, reinforced the already significant devaluation trend of the British Pound. The Bank of England had to intervene.

Japan’s central bank could end decades of quantitative easing

In Japan, too, there were sharp movements in the domestic currency – in particular a devaluation. The Bank of Japan is the last relevant central bank in the world that has not yet adjusted its monetary policy to the new inflationary environment. Consequently, the Japanese Yen depreciated. This took place despite repeated attempts to counteract the pressure by selling foreign exchange reserves. Japan is likely to succumb to this pressure from the capital markets in 2023. The Bank of Japan sent a first signal at the end of 2022, with a slight adjustment in yield curve control.

The big questions for 2023

2023 is likely to be marked by fears of a global recession as well as political conflicts. The performance of the Euro should depend on how badly the predicted recession will hit Europe relative to the US and how successful monetary policy will be in fighting inflation. The effects of monetary tightening on the real economy should be in full force in the current year.

7orca expects 2023 to remain volatile on the foreign exchange markets due to the uncertain political and economic environment.

2 Focus on global FX markets

2.1 Monetary Policy

Noticeable interest rate steps by the most important central banks

Monetary policy became increasingly restrictive in 2022. In the last quarter, noticeable interest rate increases again took place in the majority of economic areas. The Fed, ECB, and Bank of England each raised the key interest rate by 75 basis points in November. However, the most important central banks are communicating a decline in the pace of further interest rate increases. The first moderate attempts at curbing have already taken place. The RBA (+25 basis points) in Australia, the BoC (+50 basis points) in Canada and most recently the ECB and the Fed (+50 basis points in December) reduced the pace compared to the previous interest rate steps. Even if this is currently decelerating, Powell (Fed) made it very clear that a reduction in the interest rate can only be expected if there is a sustained reduction in price pressure. With inflation still far too high and excess demand on the labour market, this seems rather unlikely in 2023. In the survey of FOMC participants (Summary of Economic Projections), an overwhelming majority stated that they expect an interest rate of more than 5% in the USA in the coming year.

Most recently, the ECB ensured lower FX hedging costs

The ECB is even further away from this step and must first raise the key interest rate into restrictive levels. In the last press conferences, the credible understanding for this necessity was established and the widening of the interest rate differential in relation to the United States was limited. This significantly lowered the depreciation pressure of the Euro in the last quarter of 2022. For European investors, FX hedging costs also reduced in this context against a number of currencies. Furthermore, the interest rate increases also translated into higher yields on long-term government bonds (cf. Figure 2.). This desired effect should ideally lead to a consolidation of government budgets, which should have a positive effect on price developments via the demand side.

Figure 2 | Development of 10-year government bond yields in selected currency areas in 2022

Source: Bloomberg (01.01.2022 – 31.12.2022)

2.2 Economy

Recession on the horizon

The economic slowdown, which had become apparent in a number of leading indicators such as the purchasing managers‘ indices in the last quarter of 2022, continued to materialise. After the gross domestic product in the G20 countries contracted in the second quarter compared to the previous quarter, it grew only moderately in the third quarter. However, the economic situation is heterogeneous across the countries. While the USA experienced robust growth of 2.9% after two negative quarters, the Eurozone stagnated with slight growth of only 0.2%. The Chinese economy, as a global growth engine, grew again in the third quarter (+3.9%). With a withdrawal from the zero-Covid policy, there is considerable growth potential, which is likely to be exploited in 2023.

At the lower end of the growth spectrum are developing countries such as India and South Africa. Yet, also industrialised nations such as Great Britain or Japan are struggling with a decline in economic output (cf. Figure 3). The change from the previous quarter points to a further slowdown in many G20 countries (cf. Figure 3 at the bottom). Only four of the G20 countries were able to substantially accelerate growth. After the difficult post-Covid years, many countries are still below their pre-Covid levels due to slower growth. The International Monetary Fund forecasts a recession for one third of the world economy.

Figure 3 | Gross domestic product, growth and change from the previous quarter.

Source: International Monetary Fund (IMF). (30.09.2022)

*Data for the third quarter is not yet available for India, the last data point is used instead.

Avoiding overheating of the US economy, stagflation in Europe

Subdued economic growth is relevant for the currency markets in two ways. In the US, due to the overheating of the economy in 2022, this is a necessary condition for flatter price increases and, in consequence, for the Fed’s interest rate setting. The higher the inflation, with the economy remaining robust, the longer the key interest rate remains high and the stronger the upward pressure on the US Dollar. The same reasoning applies to the development of unemployment. Thus, the focus will remain on the real economic indicators in 2023. In Europe, the economic situation is more diffuse. Although there is also excess demand, this is due to a supply shock on the commodity markets. However, this constellation is not static. Rising unit labour costs and higher inflation expectations can already be observed. There is an acute risk of a stagflationary scenario occurring in Europe.

2.3 Price development

Great concern inflation

Inflation remains at a very high level. It varies considerably in the Eurozone within the member countries. In France, for example, it most recently stood at 6.2%, while in Eastern Europe the price increase was over 20%. In the core rate, too, the price increase was at a strongly elevated level. However, a slight decline in the rate of increase of core inflation can be observed recently in some European countries and especially in the United States (cf. Figure 4).

Figure 4 | Core inflation rates of selected G20 countries, change from previous month on an annualised basis.

Source: Bloomberg. (November 2022 vs. October 2022)

*Data from the last item on hand is used.

Stable inflation figures in sight?

The reduced core inflation led to a depreciation of the USD in the last quarter of 2022, also due to the hope that the interest rate cycle will reach its peak soon. However, these are the first data points that point to a deceleration of the price development. The evidence is not yet sufficient to suggest that a trend reversal has already begun. Prices tend to fluctuate strongly at higher levels. The euphoria of capital market participants can therefore quickly evaporate and reverse in the event of a surprisingly high price increase. Therefore, there will also be a strong focus on the common price indices in 2023. The monetary policy derived from this will determine the further course of the foreign exchange markets.

2.4 Geopolitics

Increased state intervention likely

There are many indications that the geopolitical tendencies of 2022 will continue in 2023. The Inflation Reduction Act in the United States is now also understood in Europe as a massive subsidy programme for the US economy. The EU will most likely introduce a new industrial policy on this basis, which will be characterised by increased state intervention. If these subsidies are counter-financed by new debt, this will send demand-side impulses that usually have price-increasing effects, which in the medium term will have an impact on monetary policy and thus on the exchange rate.

United States and China go separate ways

The United States are also increasingly asserting its interests against China with protectionist means, such as the sanctioning of exports in the semiconductor industry. For its part, the Chinese government is stringently pursuing a policy of strategic autarky. This decoupling could also be observed in the exchange rate. The USD/CNY exchange rate, which has traditionally moved in tandem, decoupled significantly in 2022 (cf. Figure 5).

Figure 5 | Decoupling of the USD/CNY since the beginning of 2022 (indexed to 100).

Source: Bloomberg. (01.01.2022-31.12.2022)

3 Eurozone and United States

“In particular, we judge that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictiveto ensure a timely return of inflation to our two percent medium-term target.”

Christine Lagarde, ECB President, December 2022 – ECB Press Conference

Monetary policy

Balance sheet contraction at Fed and ECB, though not to the same extent

European monetary policy remains less restrictive than in the US. However, the ECB recently made efforts to scale back some stimulus measures. For example, the ECB abolished an important credit stimulus tool (TLTRO). The premium that banks now have to pay on this programme led to an early loan repayment of more than EUR 800bn and thus to a large initial balance sheet contraction. An active balance sheet reduction, as in the USA (balance sheet reduction USD 95bn per month), in the form of a systematic phasing out of its bond purchase programmes was decided by the ECB at its last meeting in December 2022. The stability of the Eurozone depends on the question of how these programmes are handled, as the refinancing costs of highly indebted countries are curbed at the longer end of the interest rate curve via these programmes. For example, at the end of the first quarter of 2023, the balance sheet total is to be reduced by EUR 15bn per month via the Asset Purchase Programme (APP).

Recovery of the EUR/USD exchange rate

The ECB’s last interest rate steps were able to narrow the interest rate differential somewhat due to the slowing pace of interest rate increases in the US. This not only led to a recovery in the EUR/USD exchange rate, but also to a reduction in hedging costs from the perspective of European investors. The market is pricing in an interest rate peak in the US at the beginning of the second quarter of 2023. In Europe, there is speculation on a similar point in time. In this base scenario, a comfortable interest rate differential remains, which continues to provide investment incentives in the US compared to the Eurozone and should thus favour an appreciation of the US dollar. From a monetary perspective, the recent substantial Euro strength thus seems fundamentally incomprehensible.

Figure 6 | EUR/USD exchange rate and hedging costs

Source: 7orca Asset Management AG, Bloomberg. (01.01.2022-31.12.2022)

Price development

Slowing inflation

The price trend measured via the consumer price index has declined in Europe (10.1%; previously 10.7%) as well as in the US (7.1%; previously 7.7%). Supply bottlenecks appear to be easing, at least temporarily, which also points to a decline in the price level. Global freight costs (Source: Freightos Index. Change of 75.8% (31.12.202 vs. 30.12.2022). The Bloomberg Baltic Dry Index also indicates a reduction of around 48% compared to the previous year and 78% compared to the peak in October 2021.) have fallen to the level of November 2020, depending on the index, to around 25%-30% of their peak.

Producer prices also fell in the USA (-0.7 percentage points) and in Europe (-11.1 percentage points). This is due in particular to the easing on the commodity markets, especially in Europe and more specifically in Germany (-11.3 percentage points). The core inflation rate also seems to have peaked in Europe and the USA. Slight declines have been recorded. If this trend continues, consumer price development is likely to decline further.

Inflation peak seems to have been passed, 2% target in the distant future

However, this is only one side of the data. The core inflation calculated by many central banks consists to a relevant extent of the development of housing costs and in the US also to a large extent of the prices of services provided. Since the development of housing costs is only considered in the consumer price index with a delay due to the slow pace of adjustment (e.g., rental contracts: inflation adjustment not every month), this effect has not yet fully taken effect. Services, which are driven by unit labour costs, make up the largest component of core inflation and have risen most recently in the US. The reason for this is a low labour market participation rate, which led to a stressed labour market. For every unemployed person, there are two job vacancies. Another factor driving up prices was the surplus savings rates that built up during the pandemic. These have recently been reduced noticeably in the US. However, tuition debt relief, as sought by the Biden administration, could send the next demand-side stimulus into the system, which could further strengthen the excess demand.

Overall, the picture is one that points to an overshooting of the inflation peak. At the same time, it should not be forgotten that the inflation target is 2%. This is unlikely to be reached in 2023, neither in the US nor in Europe. Furthermore, the decline in prices in Europe could be temporary, depending on how commodity prices develop in the coming year. If inflation proves to be persistent in the US, higher interest rates than currently priced in are to be expected. This would most likely result in a further depreciation of the Euro against the US dollar.

Economy

At least cooling down of both economies

Regarding the business cycle, there is now widespread agreement among economists that a recession will take place in Europe in 2023 and that there will at least be a significant deceleration in the United States. The purchasing managers‘ indices often consulted in this context fell well below the expansion threshold of 50 in the course of 2022 (Eurozone 47.8 vs. US 46.4). This represents the supply side of macroeconomic value creation. The demand side presents itself differently. Retail sales rose by 1.3% month-on-month in the US, while they contracted by 1.8% in the Euro area. This demand-side discrepancy is an indicator of the divergence between supply and demand in the US. This also illustrates the different task of the Fed compared to the ECB. The former has to curb consumption, the latter hardly has any further leeway there.

In a Fed survey of professional forecasters, there was another negative revision of economic growth in the US. This now stands at a median of 0.7% (previously 1.3%). A similar survey by the ZEW Institute in Germany suggests a range between -2.2% and 0.7% with a median at 0.2%.

Geopolitics

USA further increases its competitive advantage over Europe

As part of the Inflation Reduction Act (IRA), the Biden Administration passed a comprehensive subsidy package. The legislative package includes an investment volume of more than

USD 400bn, which is to be allocated in particular to the energy sector. (Source: US Senate publication) In this sector, the US is further expanding its competitive advantage over Europe. This is reflected, among other things, in significantly lower producer prices and higher productivity, measured in terms of value added per hour worked relative to unit labour costs. This ratio was recently 8% higher in the US than in Europe. The strategic energy reserves in the United States, combined with stringent industrial policy, suggest that this competitive advantage will expand. Energy-intensive products will be more attractive in the US from a cost perspective, due to the foreseeable uncertain supply situation in Europe. These framework conditions set the incentive for investments by European investors in the US, which would imply a structurally weaker Euro. It remains questionable whether a similarly structured subsidy programme will be adopted in Europe in response to the IRA. However, a subsidy race would have a price-driving effect via an expansion of deficits.

4 Great Britain

Monetary policy

Maximum turbulence, Mini Budget

In the third quarter of 2022, an extraordinary monetary stress situation occurred in the UK. The Truss government’s deficit budgeting, often dubbed the “Mini Budget”, led to a massive rise in long-term government bond yields (cf. fig. 2). The rise triggered a sharp fall in the value of interest rate derivatives held by UK pension funds and resulted in large margin calls. These were mainly settled by the sale of relatively stable-value long-term bonds and caused yields to rise. When market participants became aware of this cycle, there were hardly any buyers for the government bonds at the peak. The Bank of England intervened, bought, and thus calmed the markets. At the same time, panic selling led to a sharp depreciation of the British Pound and a jump in hedging costs against the Euro. Mrs. Truss’s ouster and a revision of the budget led to a stabilisation at the end of the year, so that the British Pound depreciated moderately against the Euro over the year. This trend was reinforced by a more aggressive ECB at the end of 2022.

Figure 7 | EUR/GBP exchange rate and hedging costs

Source: 7orca Asset Management AG, Bloomberg. (01.01.2022-31.12.2022)

Price development

Questionable top position – inflation rate of 11.1%

With an inflation rate of 11.1%, only Italy and the macroeconomically imploding countries Russia, Argentina and Turkey have a higher rate of price increases than the UK within the G20. The cordoning off from Europe, the largest trading partner, is taking its toll. A rising labour cost base, especially for low-skilled workers (average wage increase was 6.1% recently), caused prices to rise sharply. However, due to the global factors that are currently lowering prices (as described at the beginning and in the chapter 2 chapter on the USA), prices are nevertheless expected to fall in the coming year – starting from a strongly elevated level.

Among the country-specific factors, the fiscal policy orientation of the Sunak government, which is slowing down the demand side with targeted tax increases and reduced government spending, should be seen as positive. The announced rapprochement with the EU, which Sunak is striving for along the lines of Switzerland, is also positive and should have a price-reducing effect. This is especially true if the labour market is reintegrated into the European economic area.

Economy

Recession since Q3 2022

The UK has been in recession since the third quarter of 2022. This was stated by the British „Office for Budget Responsibility“ in its autumn statement. On the production side, the industry contracted by 2.6% in November 2022 and retail sales have fallen from 2% to 0.6%. The expectation for 2023 also looks unfavourable from a UK perspective. For example, economic growth is now forecast to be significantly negative in the current year. The OECD now expects the UK economy to have the third lowest growth rate in the G20. Only Germany and Russia are behind it. Long-term productivity growth is also currently rather subdued. GDP per hour worked in 2021 was similar to Italy. The outlook is likely to stand in the way of a renaissance of the British Pound in the sense of a substantial appreciation in 2023.

Geopolitics

Economic agreements offer growth prospects

As part of the Brexit, the British proclaimed the goal of reopening Britain to the outside world and freeing it from the bureaucratic Brussels rulebook. This strategy is currently bearing fruit. As things stand today, a free trade agreement with Australia and India will probably be ratified in 2023. In addition, talks on an expanded free trade agreement with South Korea began last December and should move forward quickly. If proximity to the EU were also found in this framework, this would be considered beneficial from a growth policy perspective. A structural stabilisation of the macroeconomic fundamentals could thus also strengthen the exchange rate in the long term.

5 Switzerland

Monetary policy and price developments

Strengthening the Swiss franc to immunise against inflation

Most recently, the Swiss Federal Bank (SNB) raised the key interest rate by 50 basis points to 1%. This means that interest rates in Switzerland are currently the sixth lowest in the world. In the G20, interest rates are only lower in Japan. Due to a low inflation trend in Switzerland and a hesitant ECB, Switzerland was able to keep interest rates low over the first half of 2022 without any direct consequences for the exchange rate – the Swiss Franc gained in value despite this. In the second half of the year, this trend reversed with the widening of the interest rate differential to the Eurozone. This trend reversal occurred in tandem with the increase in the hedge return, which is largely the result of the interest rate differential. The SNB explicitly reserves the right to raise interest rates in 2023, but also emphasises the possibility of supporting the currency through targeted foreign exchange sales. The potential for further depreciation of the Swiss Franc against the Euro seems limited after these statements. Another argument for a stronger Swiss Franc can be found in the SNB’s current balance sheet policy. The SNB is currently actively withdrawing larger amounts of liquidity from the economic cycle (mainly via inverse repo transactions), thereby reducing the available money supply. Furthermore, there is a strong incentive to exchange foreign exchange positions against the Swiss Franc and implicitly strengthen it. In 2022,

CHF 140bn was booked as a loss on foreign exchange. A strong Swiss Franc also reduces imported inflationary pressure.

Figure 8 EUR/CHF exchange rate and hedging costs

Source: 7orca Asset Management AG, Bloomberg. (01.01.2022-31.12.2022)

Economy

Solid economic situation

The Swiss economy can be described as robust. GDP will probably grow by 2% in 2022 and remain positive in 2023 according to SNB projections. Industrial production recently grew by 5% and unemployment is at a low level. Risks could arise from Europe-wide energy bottlenecks, but this would also weigh disproportionately on the Euro due to its higher dependency.

6 Australia and China

Strong trading partners, strong dependencies

Through a close trade relationship, the Australian economy is strongly tied to China. China is Australia’s closest trading partner and imports a large share of raw materials from Australia’s production. This relationship is evident in the balance of trade. The higher the balance from Australia’s perspective, the higher the export surplus. This amounted to around USD 100bn in 2021 and is structurally positive. The capital account represents the monetary counterpart of the real economic relationship. The higher the trade surplus, the higher the demand for the Australian Dollar and vice versa. For example, commodity prices that China had to pay on world markets (mainly to Australia) rose due to the shortage of raw materials at the beginning of the war of aggression on Ukraine. According to the Reserve Bank of Australia (RBA), a basket of key export commodities was more than 50% higher than the previous year at the height of the escalation. This drove up the value of the export-sensitive Australian economy. With China’s rigorous lockdown policy, this trend abruptly reversed at year-end 2022. As a result, retail sales in China collapsed by almost 6% year-on-year. The Australian Dollar and the Chinese Yuan depreciated in tandem. The Chinese production decline (industrial production grew by only 2.2% in November 2022 and was still 5% in the previous month) was thus reflected in both currencies.

Figure 9 | Co-movement of the Chinese Yuan and the Australian Dollar (Indexed to 100)

Source: Bloomberg. (01.01.2022-31.12.2022)