Structural Advantages of Currency Overlay Management

Having a dedicated currency overlay manager who implements a hedging strategy across all currency holdings and different investment vehicles provides a structure that brings extensive benefits. A dedicated currency overlay goes well beyond the scope of a traditional asset management mandate. By creating an investment and trading structure, professional FX management is made possible.

The structural advantages include

- Cost reduction through high implementation efficiency

- Separation of asset and currency management

- Management and monitoring of client-specific parameters

- Highly transparent implementation and performance allocation through detailed reporting

- Outsourced Currency Management including clear process documentation

- Currency expertise and experience of a dedicated contact

1. Cost Reduction Through high Implementation Efficiency

A dedicated currency overlay can achieve a significant cost reduction through efficient implementation, which quickly overcompensates for the management fee of an active or passive mandate. The cost reduction is achieved through the following effects:

Bank-independent best execution

7orca follows a best execution approach that optimises the execution quality of the hedging instruments used, thus making a significant contribution to the cost-efficient implementation as well as the overall performance of a FX overlay mandate. Therefore, the execution process is a key focus. Our portfolio managers have many years of experience and expertise in the execution of FX transactions and are able to ensure efficient execution in a wide range of market phases.

The broker panel consists of reputable global FX liquidity providers. These counterparties are placed in competition with each other and contract directly with the client’s investment vehicle. In addition, 7orca uses best execution tools and transaction cost analysis capabilities to enhance client value.

Saving transaction costs through netting

A dedicated currency overlay manager can save transaction costs by using netting effects. Netting opportunities arise when the volume of the same currency has increased in one segment and decreased in another. These volume fluctuations are the result of market value developments of assets or portfolio reallocations in different currencies. If the hedge is adjusted, transaction costs are incurred. If the currency hedging is carried out by different managers, there is usually no agreement between these managers and thus no netting. Consequently, as the complexity of the investment structure increases (number of managers and investment vehicles), netting options are increasingly abandoned.

A dedicated currency overlay manager, on the other hand, always adjusts the currency hedge on the basis of the total netted volume per foreign currency. This approach maximises netting possibilities and thus saves transaction costs. Since smaller volumes have to be traded, transaction costs are reduced accordingly.

Efficient use of liquidity and avoidance of secondary transactions

The implementation of a currency hedging strategy requires a liquidity holding. This liquidity is needed to offset fluctuations in the market value of the currency hedge (at maturity or daily through collateral management requirements). Liquidity is always required within the vehicle/segment in which the hedge is executed. If the hedging is carried out by the respective investment managers, it is required in the corresponding underlying segments. If, on the other hand, the currency hedging is carried out by a dedicated overlay manager in the overlay segment, the required liquidity is only held here.

Bundling the liquidity flows in the overlay segment is advantageous for two reasons: On the one hand, less cash needs to be held in aggregate due to portfolio effects, so that the investment ratio of the portfolio can be increased. Secondly, more control over the liquidity flows can be achieved through dedicatedised management

Should the respective investment managers individually control the currency risks and must service the currency-related liquidity flows from their respective segments, additional costs may arise from secondary transactions in the underlyings. If assets have to be bought or sold to create liquidity, the transaction costs are significantly higher. This is particularly the case when illiquid assets are involved. The dedicated currency overlay can reduce costs through fewer secondary transactions in the underlying investments and make more efficient use of liquidity.

2. Separation of asset and currency management

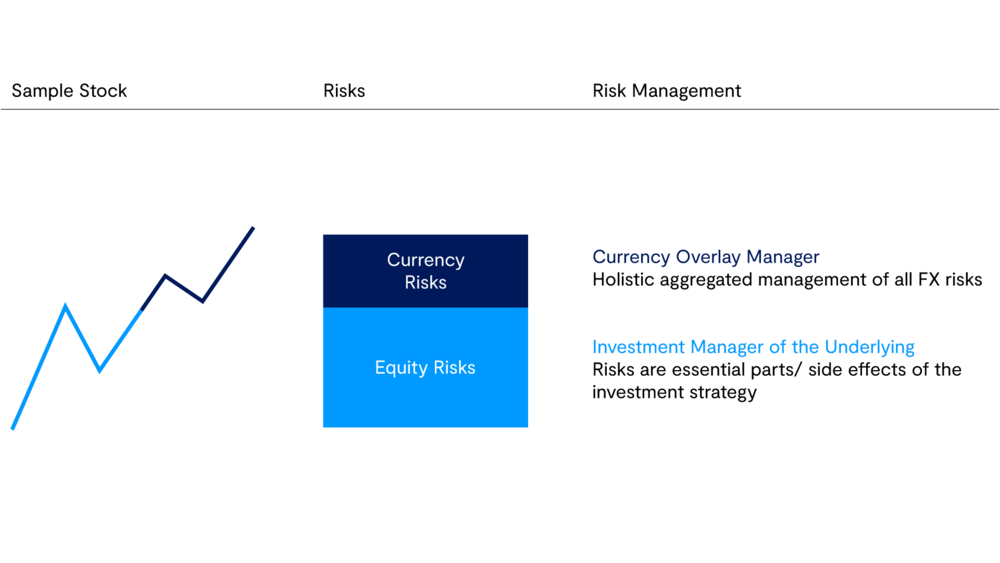

Foreign currency risk management is often linked to the management of risk-generating assets. However, the share of FX exposures in the overall allocation has increased significantly in recent years for many institutional investors across many asset classes. The introduction of a dedicated currency overlay allows for the separate management of assets and foreign currencies (see Figure 1).

Fig. 1 | Indicative representation of equity risk management

Source: 7orca Asset Management AG. For illustrative purposes only

Thus, the increased relevance of FX positions in the entire portfolio is taken into account. A dedicated currency overlay offers advantages from both a strategic and operational perspective. This separation allows for the development of an FX strategy that is accompanied and implemented by both a strategic and a tactical asset allocation. Likewise, clear responsibilities can be defined on the investor’s side and the best manager for implementing the FX strategy can be selected.

Operationally, separation also brings some advantages. A variety of reasons may require the hedging level of currency positions to be adjusted quickly and easily. These range from changes in tactical asset allocation to accounting or regulatory motives (such as valuation reserves or Solvency II ratios) to currency-specific reasons (for example, due to Brexit).

If currency hedging is carried out by the respective investment managers, this is specified in the respective investment guidelines and reflected accordingly in the benchmarks of the mandates. However, with a larger number of different investment managers, this tends to lead to an inflexible and rigid construct. A change of the static hedge ratio would lead to a high administrative effort. Changes to investment guidelines and benchmarks can take some time.

When implementing a dedicated currency overlay, the process for adjusting the hedge ratio is defined in advance. This creates the necessary flexibility to be able to adjust it at any time in an uncomplicated manner and, if necessary, across different investment vehicles, with recourse to the currency overlay manager as the single point of contact. As a result, it is possible to react swiftly and precisely to changes in the framework.

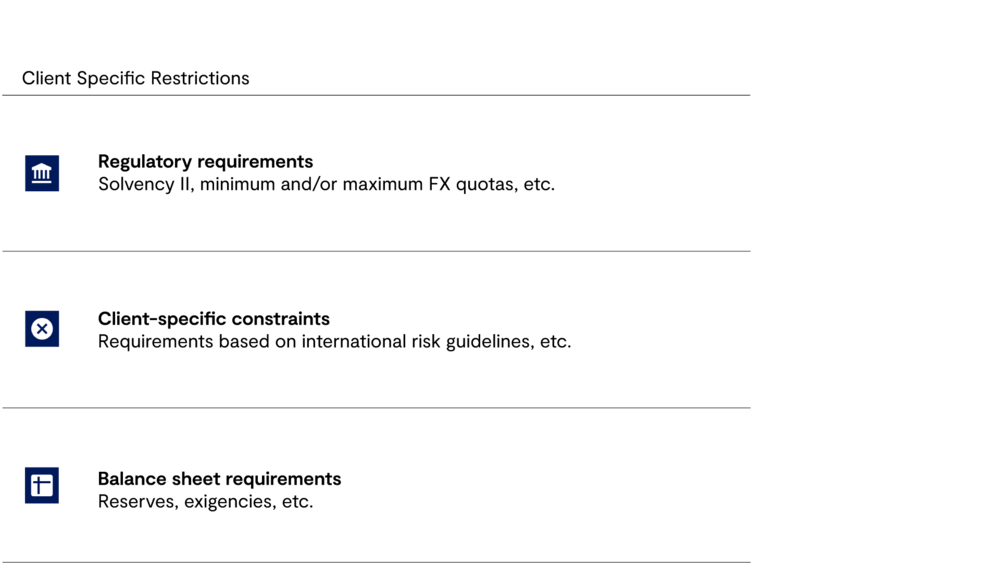

3. Management and monitoring of client-specific parameters

Large institutional investors often have a tight corset of individual specifications that have to be considered in currency hedging (cf. figure 2). These can lead to greater challenges in the implementation of the hedging strategy. For example, different risk budgets as well as regulatory or in-house requirements may necessitate an individual approach to the various FX exposures (e.g. in different investment vehicles).

Fig. 2 | Examples of client-specific requirements

Source: 7orca Asset Management AG. For illustrative purposes only

These specifications must be continuously monitored and implemented by the management, taking into account the individual mandate restrictions. Moreover, it is necessary that a reporting infrastructure ensures transparent and continuous information regarding compliance with these individual requirements.

A professional currency overlay manager integrates these specifications into its portfolio management systems and guarantees ongoing compliance. 7orca’s state-of-the-art technology platform is designed to map specific restrictions and calibrate the hedging strategy accordingly.

4. Highly transparent implementation and performance attribution through detailed reporting

A client’s foreign currency holdings are often spread across different mandates and investment vehicles (e.g. direct holdings, master funds, national and international special and public funds, ETFs, etc.). This is why transparency in the implementation as well as the possibility to map the currency holdings in different aggregation levels are the fundamentals of a substantiated overlay management.

In addition, the performance of FX positions and their hedging needs to be presented in a comprehensible way. In its role as dedicated currency overlay manager, 7orca provides its clients with a consistent, customised currency report across all vehicles and segments.

This report can be customised multidimensionally: the client determines its scope, content and level of detail. Both the performance attribution of the individual segments and the performance attribution relative to the defined benchmark can be presented.

This creates transparency and enables a meaningful comparison of the currency performance of the individual segments. In addition, the reporting requirements can be elaborated with a third party, which then prepares the reports on an independent basis.

5. Clear Process Documentation of the Outsourced Currency Management

As the investment complexity increases, so does the effort required for FX management. Holistic currency management entails considerable operational work and a large number of tasks. A dedicated currency overlay manager controls and coordinates all processes related to the mandate and thus significantly reduces the operational burden of its clients after the initial implementation.

In FX management, 7orca uses specialised and coordinated software with numerous immanent checking routines. Due to its resilience, scalability and robustness, it makes a significant contribution to risk management. As the currency manager takes responsibility for the risk management of currency positions within the dedicated FX overlay, clear documentation of the processes is equally important.

Another key ingredient for success, besides the thorough process planning by the overlay manager, is also his communication with all parties, such as the client, the capital management company, the depositary and the managers of the underlying investments.

The team at 7orca has decades of experience in implementing highly complex FX overlay mandates for a wide range of clients. 7orca documents the technical approach in an individual currency overlay project manual. This serves as an audit-proof documentation of the agreed processes and procedures.

6. Currency Expertise and Experience of a Dedicated Contact

Commonly, foreign currency positions are among the largest single risk drivers of an institutional portfolio. Therefore, it makes sense to have a dedicated contact for all FX-specific issues. This contact also makes adjustments in the event of structural changes. 7orca sees itself not only as an advisor and sparring partner, but as a proactive companion in all currency-related matters. In addition to the operational management of the currency overlay, this includes a range of associated topics where 7orca acts as an independent and proactive advisor. Examples of such special topics can be

- Determination of the optimal hedge ratio at individual or aggregate portfolio level

- Analyses, calculations or data supply for strategic asset allocation with regard to currency optimisation, risk analyses, etc.

- Development and optimisation of a structure for hedge strategy implementation

- Market analysis of individual currencies or currency-related instruments (e.g. hedging costs) with specific recommendations for action if required

- Analysis of events and special situations, if necessary deriving a recommended course of action

7orca has learned from experience that during the implementation and management of a mandate, further questions and complex issues will arise. 7orca will always be available to its clients as a reliable and highly competent partner.