Hedging of currency risks

In addition, risks from foreign currency exposure are not rewarded by a natural risk premium, which is why managers typically apply some form of currency hedging. In the search for flexible solutions for limiting currency risks, institutional investors have increasingly turned towards active overlay strategies, which are currency hedging strategies that adapt their hedge to the market environment.

The quantitative approach

Quantitative hedging programs base their trading decision on algorithms, which are mainly trend-following and use technical and sentiment indicators related to behavioural finance. Other algorithms also use macro-economic factors.

By using computer-based algorithms quantitative managers avoid the problems of discretionary decision making by the portfolio manager. This also allows for standardised testing of the implemented algorithms. 7orca follows such a quantitative, price-based and trend-following approach, which dynamically adjusts the degree of hedging in order to give our customers the benefit of participating from positive movements, in addition to hedging in downtrends.

Artificial intelligence opens up new possibilities

Increasing availability of data and ever-growing computational capacity have helped to advance artificial intelligence methods, whose effectiveness until recently had been relatively limited. In the light of these developments it has become increasingly attractive to exploit the potential of AI for the quantitative hedging approach.

Artificial neural networks constitute one of AI’s most popular methods. Initially they were inspired by the synaptic connections between neurons in the animal brain, but have long since developed into an independent discipline of machine learning. They have proven their ability to recognise complex patterns in data, for example in machine vision. This also makes them interesting in the context of analysing market movements whose complex dynamics are notoriously difficult to decipher.

How an artificial neural network works

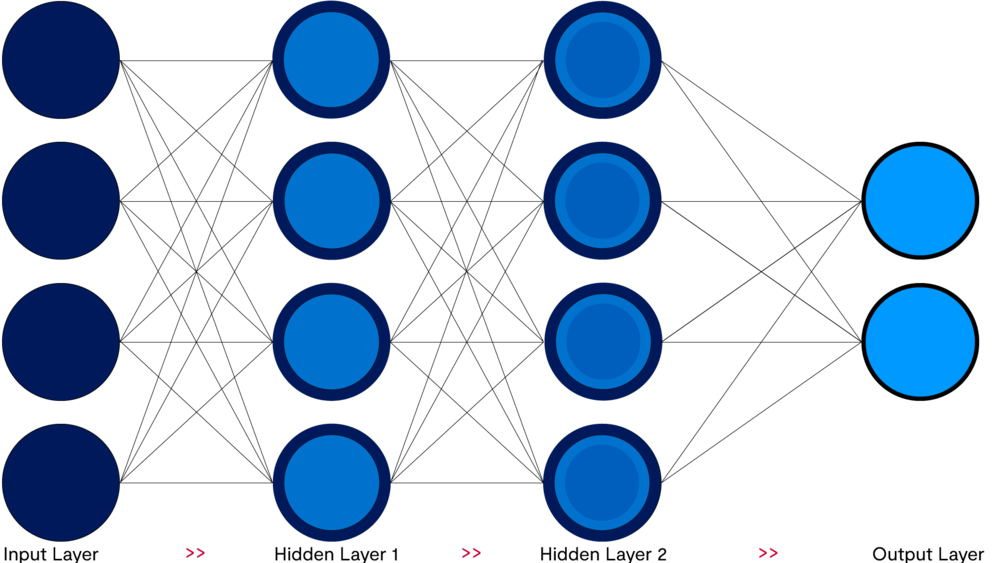

Neural networks process data via a series of consecutive and interconnected layers.

Each of these layers consists of a number of nodes. In a typical feedforward network, each node in a layer is connected to each node in the next layer. The name „feedforward“ describes the fact that the information flows from the input layer via the inner layers to the output layer.

Each node aggregates the information of all its predecessors. This is achieved by constructing a weighted sum from the outputs of all directly connected predecessor nodes and applying a non-linear activation function to the result. The output value of the activation function in turn serves as input into the next layer. The aggregation weights are free parameters associated with the connections between the nodes.

Although each individual aggregation step is relatively straightforward, such a network is able to implement highly complex functions by repeated and interdependent execution of the simple aggregation step.

The learning algorithm

Some elements of the network, like the number of layers and the type of activation functions, are set a-priori. The connection weights on the other hand constitute the set of learnable parameters. In order to teach the network the right behavior, one feeds the network with training data and compares the resulting predictions with the correct answers. The so-called backpropagation step then works out the influence that each weight has on the prediction error. In other words the information now flows backwards through the network from the output layer to the individual weights. This allows the learning algorithm step by step to change the weights so that the error is reduced until an optimal configuration is found.

Balance between under- and overfitting

Neural networks typically have a large number of connections, and so a large number of weight parameters. This gives rise to the risk that the algorithm adapts too much to the training data so that performance on new data deteriorates.

This problem of overfitting can be countered by a sufficiently large amount of training data. Also,there are various methods that effectively counteract overfitting. For example, weight-decay regularisation modifies the cost function by adding a weight-dependent penalty term to it. This prevents the network from relying too much on individual connections and allows for finding a balance between undercutting and overfitting.

The model is cross-validated by keeping data for the training and validation steps separate. The weight parameters are derived exclusively from the training set and the network is then tested on the validation set. A comparable performance of the network on both data sets is a prerequisite for the successful application to new data in production.

Trend identification with artificial intelligence

In the context of dynamic and trend-following currency hedging, the problem of trend detection is central. Trends must be identified when they emerge, so that they can be successfully exploited by the hedging strategy.

Artificial intelligence can be applied here by building a network that can interpret market data with respect to emerging trend patterns. In order to provide the correct answers for the training period, the trends prevailing at any time can be determined with hindsight. The information contained in the data is transformed and structured while it travels though the inner layers of the network to the output nodes, where the network provides an assessment on the prevailing trend direction.

The illustration on the following page illustrates how an artificial neural network works.

Fig. | Illustration of an artificial neural network

Source: 7orca Asset Management AG

Advantages of artificial neural networks

For currency overlay management, machine learning approaches of artificial neural networks offer some advantages:

Neural networks are able to discover unknown relation- ships. Therefore, they complement traditional technical models, where the algorithm is predetermined, and increase the methodological diversification and stability of a multi-model based strategy.

Neural networks can process large amounts of information and can be adapted to handle different kinds of input data. This allows neural networks, for example, to equally learn from the data from different currencies, which increases its robustness.

The flexibility of neural networks enables them to view the respective market environment from several perspectives at once and then arrive at a well-balanced conclusion.

Neural networks can continue to learn from new data in production and so gradually develop with the market.

Conclusion

The successful application of a neural network depends on various factors such as data pre-processing, network architecture and the application of the regularisation methods. Applied with adequate prudence, artificial intelligence has a significant potential for the development of successful hedging strategies. Therefore, 7orca believes that machine learning is an important diversification of its model-driven hedging approach.