Short Volatility Investments

Alternative Source of Return for the Portfolio – the Volatility Risk Premium

The current capital market environment is a real challenge for institutional portfolios and achieving return targets remains difficult. Alternative risk premiums, such as the volatility risk premium, are expanding the spectrum of investment opportunities. The 7orca Vega strategy efficiently exploits this source of return. You can choose a special fund tailored to your needs or our established mutual funds 7orca Vega Return and 7orca Vega Income as investment channels. In a personal meeting, we will gladly explain to you how you can use the short volatility strategy to create value in your portfolio context.

Strategies that broaden the investible investment universe without market timing are attractive portfolio building blocks. In addition, volatility risk premium strategies in assets not subject to trends broaden the strategic allocation and can generate attractive returns.

Science-Based Premium

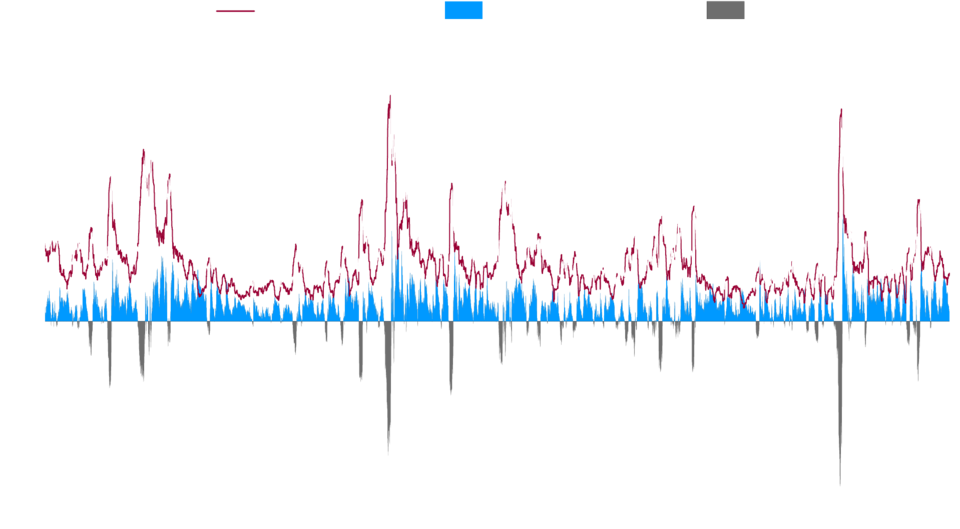

The volatility risk premium exists because over a long-term period, the expected, i.e. implied volatility is higher than the volatility that actually occurred, i.e. realised volatility.

This is due to the fact that market participants expect greater fluctuations in the long term than actually occur.

This difference is the basis of the volatility risk premium: the premium fluctuates over time, but is systematically positive over a long period. It is not a short-term inefficiency, but a science-based risk premium.1

Insurance Example

The functioning of a strategy that uses the volatility risk premium as a source of return can be compared to the classic business model of an insurance company.

A motorist regularly pays a premium to the insurance company in order to receive a payout in the event of a claim.

For the insurance company, this business model is attractive because the long-term premium income exceeds the claims payments.

Short volatility strategies follow the same principle: the strategy acts as an insurer in the capital market by selling options to market participants who want to hedge their portfolios against strong, usually negative fluctuations.

Since the volatility risk premium is systematically positive over a long time horizon, the strategy records positive performance over the long term.

Investing in Volatility

There are several ways to invest in volatility. The most common are over-the-counter variance swaps and exchange-traded options.

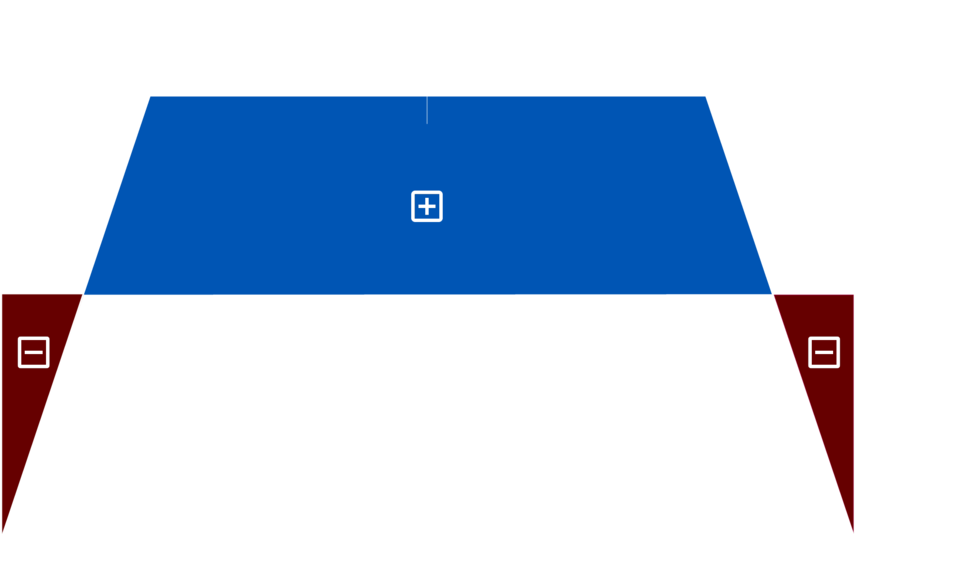

7orca sells options and thus collects the implied volatility. To do this, we set a short strangle because it is very well suited to capture the volatility risk premium in both a market environment with increased volatility and a sideways movement. A short strangle consists of a short call with a higher strike price and a short put with a lower strike price. Both options have the same underlying and the same expiry date, but different strike prices.

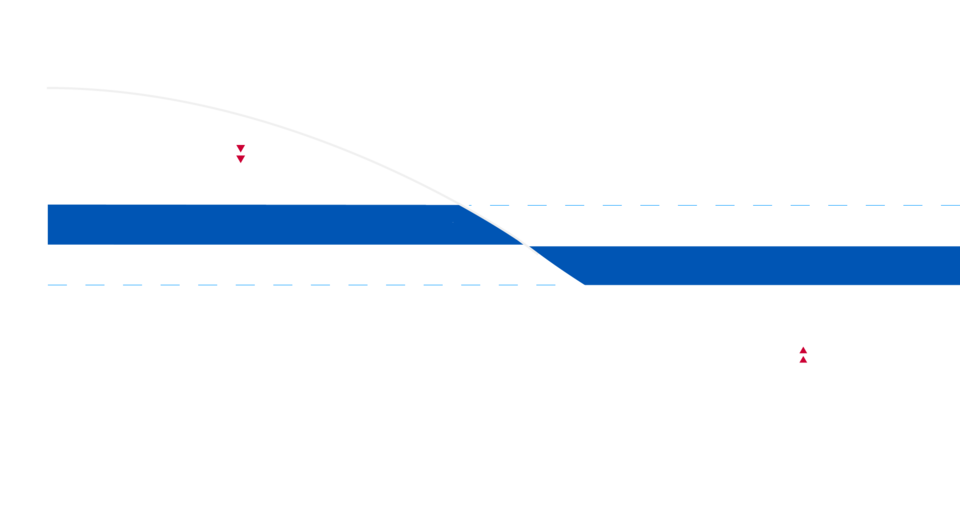

Short Strange: Option strategy consisting of a short call and a short put

Underlyings in which volatility can be collected

Academic publications on the underlyings of the volatility risk premium are mostly limited to the equity markets.

However, there are advantages for investors if the volatility risk premium is also collected on the fixed income and currency markets.

Possible underlying assets of a short volatility strategy:

| Equities | Bonds | Currencies |

|

|

|

Risk Management

Risk management is of particular importance in a short volatility strategy.

Consequently, we already implement risk-reducing measures ex ante, before the investment. Among other things, we create a risk-reducing diversification by using different underlyings. By dynamically controlling the exposure of the strategy, we can close risk positions in adverse market phases.

Fat tail risks arise for short volatility strategies in particular through changes in delta 1

Therefore, we have implemented a systematic, balanced delta cap risk management for our 7orca Vega Strategy. Our proprietary delta cap is particularly effective in persistent trend markets and takes effect swiftly in the event of strong movements. At the same time, we have defined a corridor within which the delta of each underlying is allowed to „breathe„, thus avoiding cost-intensive, high-frequency hedging.

1 Delta is a measure of the change in the price of an option (i.e. the option premium) resulting from a change in the price of the underlying.

„Escalator up, lift down“

The performance characteristics of a short volatility strategy can be well illustrated with a picture:

the strategy achieves steady premium income in moderately rising and moderately falling markets as well as in volatile sideways markets. This phase of premium collection can be compared to an escalator ride upwards.

In strongly rising or strongly falling markets, the „claim event“ occurs for the strategy, and the strategy as a capital market insurer records abrupt negative performance. This violent, usually short phase can be described as an elevator ride down.

To stay in insurance parlance: The downward lift ride is an essential part of the strategy, which would not exist without this risk transfer. The investor has to endure this in order to be able to fully participate in the escalator ride upwards afterwards.

The compensation that the strategy pays out is offset by steady premium income in the medium term, which more than compensates for the payouts in the long term.

1 Source: Universal-Investment-Gesellschaft mbH, 7orca Asset Management AG. 7orca Vega Return investment fund, share class I. Past performance is not a reliable indicator of future results. Performance is calculated according to the BVI method (without taking into account front-end load). The investment result may also be reduced by individually incurred custody account costs. The performance from 31.12.2005 to 03.12.2017 is a simulation of the strategy executed at average market costs. From 04.12.2017 – 31.08.2021 the live performance of the 7orca Vega Return I is shown.

Transparency and Comprehensibility

Transparency is essential in a short volatility strategy:

the concepts can be difficult to grasp due to the lack of appropriate benchmarks, the use of derivatives and the highly dynamic nature of the portfolio parameters. We ensure maximum transparency and comprehensibility at all times, so that you are able to deeply grasp the 7orca Vega strategy and its character fidelity and ultimately trust the investment process. Trust is the basis for passing through the elevator ride down together.

We are at your disposal at any time to shed more light on the investment strategy and provide you with a comprehensive monthly report. Among other things, you will find a current portfolio manager commentary, the prevailing premium level and the performance aggregated as well as for each underlying.

The following chart shows the corridor of the strike prices of put and call options on the EuroStoxx 50.

Investment Routes

Investors can adapt the 7orca Vega strategy to their individual needs within the framework of a special fund.

For example, the basis of the strategy, the underlyings and the risks to be taken can be precisely scaled.

The two established mutual funds 7orca Vega INCOME and 7orca Vega RETURN offer investors proven access to the volatility risk premium. Return-seeking investors may be particularly interested in the 7orca Vega RETURN fund, which implements the short volatility strategy in a broadly diversified and multi-asset manner on the underlyings equities, bonds and currencies. More conservative investors might find the 7orca Vega INCOME attractive, which only uses the underlyings bonds and currencies.

7orca Asset Management AG

Volatility expert for more than 15 years

As return diversifiers, investment strategies that systematically capture the volatility risk premium enrich the portfolio. As a result, a positive performance can frequently be achieved in periods in which classic (long-only) investment strategies generate no, hardly any or negative returns. The team at 7orca Asset Management AG has many years of experience in the structuring, implementation and management of short volatility solutions. We would be happy to discuss the possibilities for your individual portfolio in a personal conversation.