1 Global FX markets at a glance

1.1 Monetary policy

Inflation reduction with side effects

The pace of the current interest rate cycle continued to decline in the first quarter of 2023 and appears to be nearing its end. The Fed in the US, the Bank of England in the UK and the RBA in Australia raised the key interest rate by only 25 basis points after a series of aggressive rate hikes. The Bank of Canada stopped rate hikes completely. On the other hand, the ECB was forced to significantly adjust rates twice by 50 basis points, but signalled smaller rate steps in the future. Japan and Switzerland have hardly entered this cycle to date. Japan's yield curve control remained unchanged and the Swiss National Bank raised the key interest rate to a comparatively low rate of 1.5% (+50 basis points).

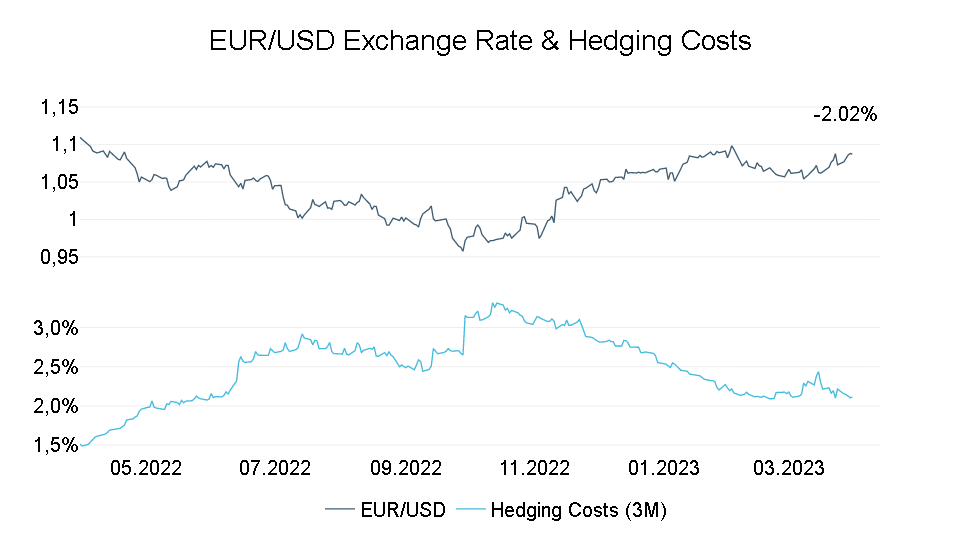

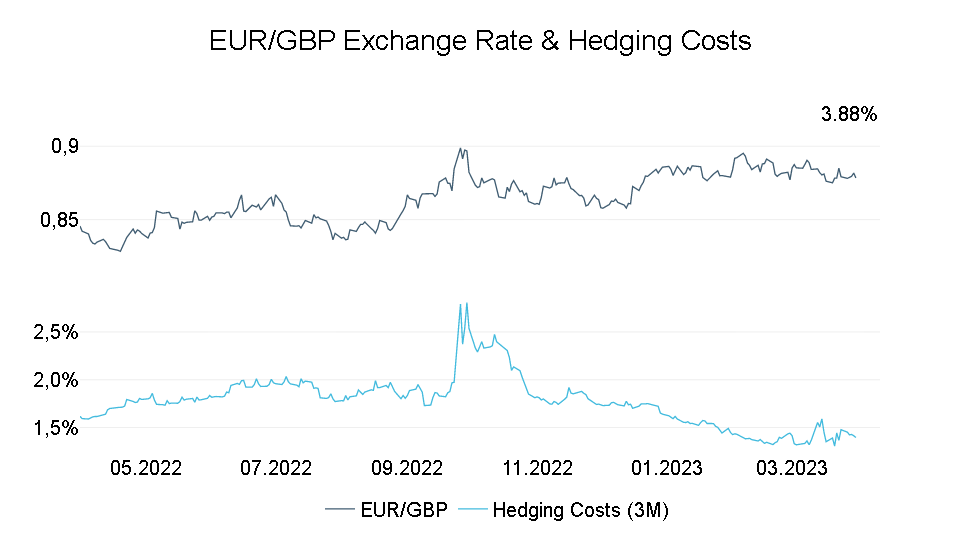

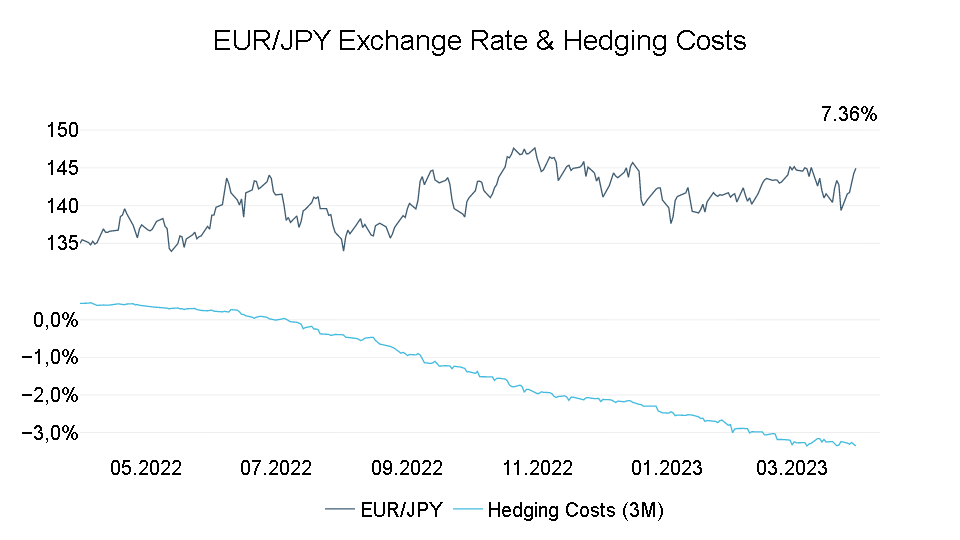

Rising European interest rates, combined with the foreseeable end of interest rate hikes, led to significantly reduced hedging costs for European investors' foreign currency investments. Hedging against the Swiss franc, the Japanese yen and the Taiwan dollar even generated considerable returns.

The development was also noticeable on the spot market. The convergence of interest rates is also responsible for the stabilisation of the euro, which was weak for long periods last year. In essence, the development of interest rates depends on the course of disinflation.

However, the insolvency of Silicon Valley Bank and the forced takeover of Credit Suisse by UBS showed that increased side effects of high interest rates are occurring. The longer interest rates remain high, the more likely bank-side liquidity and funding difficulties will occur. In this stressed environment, the safe-haven property of some currencies, such as the US dollar, the Japanese yen or the Swiss franc, could again come into focus. With the risk of cascading effects in the financial sector, central banks may be forced to intervene more. Currently, a conflict of objectives between financial market and price stability is emerging, which could significantly shape the current year.

1.2 Economy

Half as bad?

Within the framework of the most recently published "Summary of Economic Projections", the FOMC participants gave the Fed their economic assessments for the current and coming years. The forecast for real economic growth in 2023 was revised down by -0.1% to 0.4%. Thus, the current data situation suggests a cooling economy towards stagnation instead of recession. However, these forecasts do not yet include the consequences of any liquidity problems in the financial sector. It is to be expected that the events in the US and Switzerland will lead to a certain caution in the extent of lending by financial institutions. This should have a further cooling effect on economic activity.

From an interest rate perspective, one of the most reliable indicators is currently turning red: The yield curve in the US has inverted more strongly than at any time since the beginning of the 1980s. In the meantime, the spread between 10-year and 2-year US government bonds was more than -1%. This indicates from an interest rate perspective that there is a risk of an economic downturn in the US.

The US labour market remains overheated. Unemployment is at a record low and there are still almost two vacancies to be filled for every unemployed person. This has an impact on pricing in the service sector.

In Europe, the economic situation is currently very heterogeneous. While negative growth rates were recently recorded in industrial production and purchasing managers' indices in the manufacturing sector declined, economic performance on the service side increased. Consumer sentiment indices are currently coming back from their lows and retail sales were at least up 0.3% in January. Thus, a chasm is building up between the manufacturing sector and the consumers.

Overall, the European labour market situation is comparable to that in the US. Due to the high union density, higher wage agreements have a delayed effect.

Overall, there will probably not be a recession in Europe. Stagnation or low growth rates are more likely at present.

1.3 Price development

Good news and bad news

Inflation rates on both sides of the Atlantic have very likely passed their peak. This is the conclusion reached by economic research institutes and the International Monetary Fund (IMF) alike in their latest publications. In February, consumer prices rose by only 6.0% in the US and 5.2% in Canada. In the Eurozone, prices rose by 6.9% at the end of the quarter. However, this is looking at the aggregate. As the supply chain problems of the Covid-19 pandemic have eased and highly volatile commodity prices have declined in the face of the global recessionary trend, this reduction is concentrated in individual segments of the price basket. Looking at core inflation in Europe (5.6%) or services inflation in the US (7.6%), the inflationary environment is more likely to consolidate. In Australia and Japan, even headline inflation is currently gaining momentum again. The UK's outlook is particularly sobering, with inflation still in double digits. If inflation cannot be lowered further in the direction of 2%, a further tightening of the interest rate screw is to be expected.

1.4 Geopolitics

War and power struggle dampen global growth

The war in Ukraine is an immense humanitarian catastrophe that also has substantial economic costs. The current rise in food inflation (Eurozone 17.3%, USA 9.5%, UK 18% as of February) is a direct result of the conflict. At the turn of the year, the sword of Damocles of high energy prices also hovered over Europe. For the euro, this constellation continues to give rise to devaluation risks in the course of 2023. The second global conflict puts Taiwan in the spotlight. The small island state is increasingly serving as a stage on which the US and China play out their rivalry. Even if a military conflict does not seem immanent, the global economic damage of the progressive distancing of the two great powers is already foreseeable. In the short term, however, the opening up of the Chinese economy from the phase of constant lockdowns should have a positive effect on global economic growth. Most recently, the unexpected curbing of the oil price by OPEC+ by 1 million barrels a day caused concern. Artificially tightening oil supplies could once again boost global inflation and further stifle already weakening economic growth.

2 Eurozone and the United States

"We no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation. Instead, we now anticipate that some additional policy firming may be appropriate." J. Powell, President of the Federal Reserve

2.1 Monetary policy

Interest rates are expected to have reached record highs

Both the Fed and the ECB communicated clearly at the beginning of March that they wanted to tighten monetary policy further. The Fed announced that the final interest rate would be higher than in the last projections and would remain there longer than previously thought.

These statements were thrown into doubt with the bankruptcy of the American Silicon Valley Bank (SVB) and the worries about the systemically important Credit Suisse. Only that interest rates are to remain high for longer has consistency.

SVB, which specialises in start-up financing in the tech sector, had invested a large part of its deposits in long-duration government bonds and mortgage-backed securities at the valuation peak in the bond market. In the US, mid-sized banks are not required to value such securities at the current market price if they are to be held to maturity. This meant that enormous book losses which incurred during the interest rate turnaround were not recognised. As in the rising interest rate environment the depositors of the partly high-risk start-ups themselves got into liquidity difficulties, they withdrew their deposits from the SVB on a large scale. This deposit withdrawal had to be serviced by the SVB through the sale of its securities, which realised the book losses. The sale of the securities was not enough to cover the deposit withdrawal, a planned capital increase failed and insolvency had to be filed.

Now the question arises to what extent such scenarios can spill over to other institutions in other countries. In principle, this is possible, but the rules in Europe, for example, are different from those in the US. Book value losses have to be reported, which means that the local supervisors should have a good view of the stability of the financial sector. Credit Suisse, which got into difficulties, was supported by the Swiss National Bank and the Swiss government with liquidity and insolvency guarantees. In the US, a new credit programme (Bank Term Funding Program) was set up to contain the crisis at an early stage. In this programme, banks can deposit securities as collateral without valuation discounts and thus obtain liquidity at favourable rates. Due to the clear signals from the state institutions to intervene in extreme cases, the probability of a contamination of the financial market is currently considered rather low.

Against this background, the ECB's decision to raise interest rates by a further 50 basis points to 3.5% was also logical. In this context, ECB President Lagarde continued to emphasise that there was still ground to be made up, which could translate into further interest rate hikes.

However, the increased provision of emergency liquidity makes it clear that a continuation of the interest rate cycle can hardly be accomplished without side effects. This is also reflected in the latest interest rate decision and the Fed's statements that only a few, if any, tightening steps are to be expected. The interest rate cycle should come to an end in the US, provided disinflation continues as projected.

European and American interest rates should remain at similar levels in the current year. The interest rate differential and thus the hedging costs should settle at the current level. The current monetary environment also has a stabilising effect on the EUR/USD exchange rate. In the event of further turbulence, however, the USD, which is considered a safe haven, would strengthen against the EUR. The Fed's faster balance sheet reduction is also an argument for a stronger USD.

2.2 Economy

Light and shadow

A bipolar economic picture is currently emerging in both the eurozone and the US. The service sector was able to recover in March, which is reflected in corresponding purchasing managers' indices in the service sector above the expansion threshold of 50 (eurozone 52.7, US 50.6). The purchasing managers' indices in the manufacturing sector are below this level in both currency areas, which can be explained by thinning order books. In the US, new orders in the manufacturing sector fell by 1.6% in January compared to the previous month.

In the eurozone, the negative development of the production side can be explained in particular by the German-French weakness, where the declines were particularly strong. This development was also reflected in the German ifo index. Although the previously very pessimistic expectations of German industry improved significantly, the assessment of the current business situation deteriorated in February, especially in the manufacturing sector.

For the further economic development, it is crucial how the credit markets react to the withdrawn liquidity in the system. If the commercial banks were to tighten the supply of credit out of an abundance of caution, this would have a similar, cyclical cooling effect as interest rate hikes. The central banks' job would become easier and possibly avert further interest rate hikes. However, this effect is partially counteracted, as the current central bank funding programmes provided commercial banks with generous emergency liquidity. How high the net effect will be will become apparent in the coming weeks.

The current data situation suggests that a stagflationary scenario is the most likely scenario in both the euro area and the US. The comparative advantage of the US in terms of favourable energy prices makes the structural outlook there a little more positive. The economic development has a slightly negative impact on the EUR/USD exchange rate.

2.3 Price development

(Core) inflation remains high

Even though the inflation trend has passed its peak, it seems to be consolidating above the 2% target. The core PCE index favoured by the Fed to determine the medium-term price trend is at 4.6% at the end of the quarter. This still high value is driven in particular by the robust development in the services sector, where prices rose by 7.6% (the highest value since the 1980s). The gap between these ratios was only 0.5% in February.

In the Eurozone, the situation is comparable. Inflation is far from the 2% target (6.9% in March) and projections point to an increased value in the course of the year. Core inflation increased again to 5.7% (+0.4% at the beginning of the year). Inflation expectations of private individuals, surveyed by the German Bundesbank, increased slightly in February to around 6% for the coming year. On a 5-year horizon, this value averages 5%. These expectations have a substantial influence on future price formation, as consumer behaviour adjusts to these expectations in the medium term. Similar trends can be observed in other European countries.

The ECB's 50 basis point interest rate hike, despite turbulence in the capital market, highlights the urgency of tackling price developments.

Overall, an interest rate of 3.5% is rather low in such an environment. In price-adjusted (real) terms, the interest rate in the US continues to be significantly higher than in the Eurozone, which currently suggests EUR weakness against the USD from a price perspective.

2.4 Overall assessment EUR/USD

Euro weakness vs. US dollar likely

A comparably stagflationary development in the US and the eurozone hardly provides any impetus for the exchange rate from an economic perspective. In terms of monetary policy, the Fed continues to be more aggressive than the ECB. This applies equally to interest rate setting and balance sheet reduction. Price dynamics are high in both currency areas and an easing of monetary policy in the sense of an interest rate cut is therefore not in sight. The risks of further price increases are currently considerable. Especially in the eurozone, where the dependence on imports for energy supply is strong. Instabilities on the capital market could bring the safe-haven property of the USD to the fore.

Taking into account the overall macroeconomic picture, the risks are more on the side of a weaker euro against the US dollar in the medium term.

Source: 7orca Asset Management AG (01.04.2022 - 31.03.2023)

3 Great Britain

3.1 Monetary policy

Negative real interest rate

At the end of the quarter, the Bank of England decided to increase the base rate by 25 basis points to 4.25%. This followed higher-than-expected inflation, which remains at double-digit levels in the UK (10.4% in February). As this has narrowed the interest rate differential with the euro area to just 75 basis points, the real interest rate is clearly negative from a UK perspective. . In its projections, however, the Bank of England expects a strong decline in prices already in the coming quarter, which is justified by falling energy prices. These should remain low in the UK, as an energy price cap has been politically agreed for three more months (approx. 2,500 GBP per year per average household).

The Bank of England itself points to the market implied terminal interest rates of 3.5% in Europe, 5% in the US and 4.5% in the UK. This would only imply a further 25 basis points rise in interest rates in the UK and the interest rate peak in the US and the eurozone.

This mixed situation can also be read in the current hedging cost structure. The costs for a 12-month and annualised 3-month hedge are currently equalising, which implies a constant interest rate differential over time.

The interest rate environment will lose momentum in the coming months, which means that no major impulses are to be expected from this side. In combination with the inflation trend, however, there will be a negative real interest rate, which could have a negative impact on the British pound.

3.2 Economy

Bottom of the G20 in economic performance

The economic situation in the UK can still be described as tense. In its World Economic Outlook, the IMF continues to forecast a decline in economic output (-0.6%) for 2023 for the UK as the only G20 nation. Compared to the previous publication, this is a forecast revision of -0.9 percentage points. Contrary to this trend, the consumer side brightened a little, albeit at a low level. Retail sales rose by 0.5% and consumer confidence by 15% in January relative to the previous month, but remain in negative territory. Purchasing managers' indices in the services sector also improved and have now climbed above the expansion threshold of 50 (52.8 in March). However, high prices are weighing on the balance sheets of private households. Net new consumer debt increased unexpectedly by GBP 1.6bn, supporting domestic consumption but also highlighting the cost of living crisis in the UK.

On the production side, the picture is similar. Industrial production contracted by 4.3% in January, and the manufacturing purchasing managers' index remains below the expansion threshold (48.0 in March). The latter, however, represents a slight improvement from the year-end 2022 lows. This brightening is also reflected in the latest publication by the UK's Office for Budget Responsibility, which forecasts a milder recession (-0.2%) than feared in November (-1.4%).

Although the overall economic situation has brightened, there is still an economic disadvantage in direct comparison to the eurozone. The real economic side is therefore currently having a rather negative effect on the British pound against the euro.

3.3 Price developments

Britons expect prices to continue to rise

Prices in the UK continue to linger at record levels. Food prices rose 18% year-on-year in February and headline inflation remains in double digits at 10.4%, up from the previous month, contrary to market expectations. Core inflation also grew to 6.2% from 5.8% in January, revising down the previous month's decline. Producer prices remain at very high levels at 12.1%.

Consumer price expectations are adjusting and there is a risk of them becoming entrenched. For example, according to the Citi Group, inflation expectations for the next 12 months in the UK rose from 5.4% to 5.6% in February. Hopes for an improvement in the price structure could be the attempts at rapprochement with the EU. A solution to the Northern Ireland issue seems imminent and a new chapter in bilateral relations could begin. This would also bring positive effects on the price side.

Up to this point, the Bank of England is now forced to raise interest rates further. Should this not be the case, inflation threatens to decouple from the 2% target in the medium term. The markets are already pricing this in. The market-implied expected 5-year inflation can be calculated from inflation-protected government bonds. While in Europe this value is close to the 2% target, in the UK it currently exceeds 3.5%.

The price side is clearly working to the disadvantage of sterling with the monetary policy currently in place.

3.4 Overall assessment EUR/GBP

UK recession likely in 2023

The economic outlook in the UK has improved slightly, but still points to a recession this year. The price trend in the UK can be described as extremely critical and much more overheated than in the eurozone. In terms of monetary policy, the Bank of England is forced to act more restrictively, and this despite the weak economic situation. This will further worsen the already critical state of UK public finances and exacerbate any recession.

The macroeconomic picture for the British economy and the British pound is clearly negative.

Source: 7orca Asset Management AG (01.04.2022 - 31.03.2023

4 Japan

4.1 Monetary policy

Continued ultra-loose monetary policy boosts hedge return

With the latest monetary policy decision, the Bank of Japan confirmed the maintenance of ultra-loose monetary policy. The upper band of the yield curve control of 0.5% was then tested by speculators and exceeded more than 25% of the time since the beginning of the year. Only through massive bond purchases, USD 150 bn in January alone, did the Bank of Japan manage to hold the band. The imminent inauguration of the new Japanese governor Kazuo Ueda in April fuelled such speculation. He now faces the dilemma of deciding to abandon this expensive monetary policy and at the same time avoiding a Japanese sovereign debt crisis. If he succeeds in this balancing act, the Japanese yen could also regain strength in the medium term.

Until this is the case, the high and growing interest rate differential between the eurozone and Japan will manifest itself. This currently results in high hedging returns that can be generated by a JPY/EUR short position. They are currently at their highest level since the financial crisis of 2008, which makes hedging the yen exposure extremely attractive at the moment. In addition, the high interest rate differential is generating substantial depreciation pressure on the yen, which makes hedging an interesting tactical consideration at present.

Due to the distress of several financial institutions, the Japanese yen as a "safe haven" currency appreciated strongly at the end of the quarter. In the medium term, monetary policy considerations should be more relevant.

From a fiscal policy perspective, a negative yen outlook remains in the short term due to the high interest rate differential and the resulting hedging income. Should monetary policy be adjusted and yield curve control unwound, this may turn around in the medium to long term.

4.2 Economy

Strong foreign trade due to weak exchange rate

Japanese exports have been rising in recent months. Supported by a weak currency and the normalisation of supply chains, foreign trade grew by about 17% in February compared to the previous month. The weaker yen caused import volumes to fall in the same way

(around -15%), which allowed the trade deficit, which is rather untypical for Japan, to narrow significantly. The trade balance is now almost even.

On the business side, as in most parts of the G20, the purchasing managers' index rose. Again, this is particularly due to the services side, which improved noticeably to 54 in March. For the manufacturing sector, the figure for the same month was 48.6, which was already below the expansion threshold. Industrial production is also currently contracting (-5.3% compared to February).

On the other hand, consumer demand is robust and strengthened by the overheated labour market. Thus, household consumption expenditure rose by 2.7% month-on-month in January. The solid household income side helped retail sales in Japan to grow by 6.3% y-o-y in January.

Overall, the economic situation in Japan is comparable to the Eurozone on the consumer side. In Japan, the external economy is more positive due to the currency effect, but the production side re-mains tight in both countries.

4.3 Price developments

Prices require interest rate adjustment - still

Inflation in Japan remains very high. Although prices in the consumer index fell by a full percentage point in March relative to the previous month, this is almost entirely due to the Japanese government's lavish energy price subsidies. Food prices rose by more than 7% year-on-year at the end of the quarter, reaching their highest level since the 1980s. Core inflation, which excludes energy prices, rose again to 3.4% in the meantime, illustrating the structural upward drive of prices. This environment is currently putting pressure on the Japanese central bank to adjust the interest rate environment to the price environment. After years of deflationary tendencies, the central bank's self-imposed target of 2% inflation has been clearly exceeded and is gaining momentum. Extensive debt-financed spending programmes, such as the modernisation of the Japanese military, are further fuelling price developments.

Consumer inflation expectations, which are important for future price formation, also continued to adapt. According to the Bank of Japan, this is at a high of 2.7%. Very low unemployment of only 2.4% should lead to rising unit labour costs. If central bank policy remains unchanged, a higher price level will have a negative effect on the Japanese exchange rate.

4.4 Overall assessment EUR/JPY

New central banker - new monetary policy?

The economic outlook in Japan is comparable to that in Europe. Only the prospect of a robust export economy supported by the low yen could trigger positive economic impulses in Japan. On the inflation side, rates are lower in Japan, but monetary policy remains inadequate. As a result, core prices continue to rise at present. With a change at the top of the Bank of Japan, a change in monetary policy could soon be initiated.

If the Bank of Japan continues to fail to adjust interest rates to the real economy, a depreciation of the yen is inevitable in the given environment. In the event of a monetary policy adjustment, however, there is considerable short-term appreciation potential

Source: 7orca Asset Management AG (01.04.2022 - 31.03.2023)